Flooding, simply put, is an overflowing of water onto land that is normally dry. Its impacts can be severe enough to create a natural disaster that causes serious damage to property—and unfortunately in some cases—threatens lives. For communities that may be at risk to flooding and its devasting impacts, we can use flood mapping as a tool to reduce risk. But what is flood mapping?

Climate change, poor urban planning, dam failures, and other factors have resulted in more frequent and severe flood events. Large flood events can disrupt everyone from families to entire regions. Impacts like displacement of population are significant and in some cases, Flood can lead to major loss of life.

Due to hazards posed by floods, flood mapping has become vital to governments, communities, and individuals involved in floodplain management, flood mitigation, flood-related emergency management, urban planning, and related disciplines.

Throughout today’s article, we’re going to learn more about flood maps, their various uses, the different types of flood zones, and more.

What is a Flood Map?

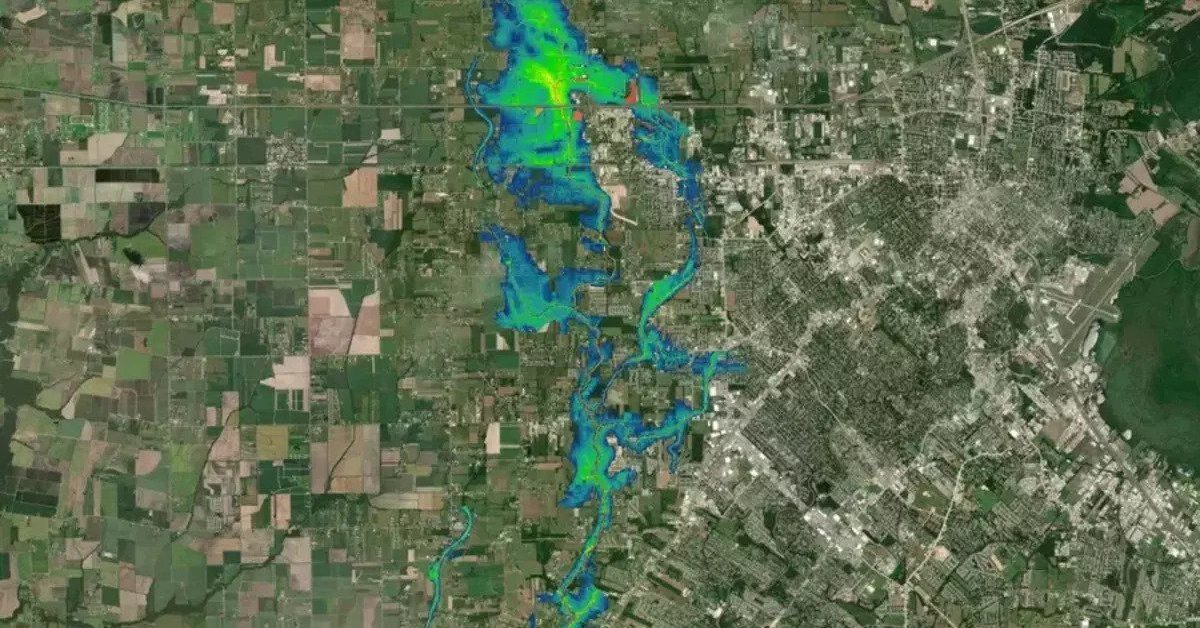

A flood map shows where water will flow during a flood and will pinpoint the land areas that could be flooded by different-sized floods. Flood mapping is conducted by government bodies, like the Federal Emergency Management Agency (FEMA), to help understand and manage flood risks.

FEMA’s flood map products are divided into two categories: regulatory products and non-regulatory products.

Regulatory flood map products are used to guide the decisions of the National Flood Insurance Program (NFIP). Managed by FEMA, the NFIP aims to reduce the damage caused by floods by restricting floodplain development. It also shares the risk of losses by providing flood insurance.

What is FEMA’s Risk Rating 2.0?

Examples of regulatory flood maps include:

-

Flood Insurance Rate Maps (FIRMs)

These maps highlight a local community’s floodplains, risk premium zones, and special hazard areas. They also highlight areas that fall within the 100-year flood boundary. The areas found within these boundaries are known as special flood hazard areas and are further subdivided into insurance risk zones. The term 100-year flood boundary means the area has a 1% chance of flooding each year, not that a flood is likely to occur every 100 years.

-

Flood Insurance Study (FIS)

Once a flood study is completed for the NFIP, the maps and data are compiled into a Flood Insurance Study (FIS). Detailed flood elevation data is presented in scannable data tables and flood profiles.

Non-regulatory flood map products are meant to be used by end-consumers rather than policymakers. They also provide a more user-friendly analysis of flood risks.

Examples of non-regulatory flood maps include:

-

Flood Risk Maps

These maps present notable flood risks for a given area in one large map.

-

Flood Risk Report

These maps are meant for local community usage as they summarize flood hazards and risk exposures for those communities.

-

Flood Risk Database

These provide actionable data that can be used for mitigation efforts and raising awareness within communities.

The public can obtain FEMA flood maps from the FEMA Flood Map Service Center (MSC). The MSC is the official public source for flood hazard information and informs the National Flood Insurance Program. People can use the MSC to find their area’s flood map, obtain flood hazard products, and use educational tools to better understand their flood risk.

What are Flood Maps Used for?

Flood maps are used by the public and private sectors, as well as businesses and ordinary citizens, to make decisions in areas as diverse as housing, zoning, land use, infrastructure improvements, and transportation networks. Flood maps also inform flood-related emergency management (including evacuations and warnings).

Flood maps play an important role in flood risk management. If developers or urban planners are aware that a specific location is part of a high-risk flood zone, they’re less likely to build important infrastructure, like schools or hospitals, in that location.

But if choices are made to build infrastructure in that high-risk flood zone, communities are also more likely to construct additional features that would safeguard the public, like flood control dams.

Flood maps also play a vital role in risk communication within communities. If residents are made aware that they live in a flood zone, they’re more likely to seek information on how to protect themselves, as well as take flood warnings seriously.

This information can also influence the decision of aspiring homeowners and property investors who may choose to purchase homes or properties in low-risk areas.

Any area with a 1% chance or greater of experiencing a flood each year is considered to be a high-risk flood zone. And since flood risks are constantly changing, flood maps are vital tools that can be used by ordinary people to understand risks and take the necessary steps to safeguard their homes, businesses, and families.

When it comes to flood-related emergency management-sometimes referred to as floodplain management-residents should pay special attention to their local flood hazard map. These types of maps can help residents identify which areas are likely to be flooded, what types of floods are most likely to occur, and how severe these floods are likely to be.

How Are Accurate Flood Maps Created?

To create accurate flood maps, detailed floodplain and river information, as well as engineering and scientific know-how, are needed. The process also requires the participation of local communities, FEMA, a floodplain administrator, engineers, and surveyors. The data is added to a computer model, which is then used to create the flood map.

Due to changing weather and environmental conditions, as well as changing flood risks, local flood maps need to be updated on a regular basis. The ongoing updates are a collaboration between local communities, representatives from FEMA, and the local floodplain administrator (who are appointed by the local municipality that they represent).

In most cases, a hydrological assessment will have to be done. Hydrological assessments are conducted to quantify the volume or flow of water in a river, reservoir, or other body of water.

This is done to assess the groundwater flood risk to a site and to evaluate the capacity of reservoirs, storage ponds, and other features to contain the floodwater. Hydraulic modeling is also done to calculate water levels along rivers for these flows. This modeling is also done to either understand stormwater flow, or flood conditions for design of structures.

FEMA and the floodplain administrator will ask community leaders and residents to share local knowledge that would help make the flood maps as accurate as possible. Meanwhile, local surveyors and engineers will collect data along the water sources and flood plains to help build the maps. The resulting data is then used to map flood risks for the community.

Once the preliminary flood maps are made available for review, the local community has several months to submit additional information to support changes or appeals to the preliminary flood maps.

What Are Flood Zones?

Essentially, flood zones are areas that are prone to flooding and the hazards associated with it. Flood hazard areas on FEMA’s Flood Insurance Rate Maps are known as Special Flood Hazard Areas (SFHAs). A Special Flood Hazard Area (or SHFA) is defined as the area that will experience flooding by an event having a 1-percent chance of being equaled or exceeded in any given year. The surface level of the water in this event is defined as the “Base Flood Elevation, or Flood Hazard Area (or SHFA) is defined as the area that will experience flooding by an event having a 1-percent chance of being equaled or exceeded in any given year. The surface level of the water in this event is defined as the “Base Flood Elevation”, or “BFE”.

FEMA defines flood zones in several different ways based on the type of flood risk in a given area. We’ll go over those categories in just a second.

What Are Moderate to Low-Risk Flood Zones?

Moderate flood hazard areas are geographic areas that fall between the limits of the base flood and the 0.2% annual-chance-flood (or 500-year flood). These areas are labeled Zone B or Zone X on a Flood Insurance Rate Map, or FIRM. These low -risk flood hazard areas fall outside of FEMA’s Special Flood Hazard Areas (SFHAs).

Along with being designated on FEMA’s FIRM’s, moderate to low-risk flood zones are also identified in Flood Hazard Boundary Maps (FHBMs). FHBM’s are the official map for a community that outlines the specific boundaries of their flood, mudflow and related erosion areas that have been identified during the investigation process for these maps.

In communities that are enrolled in the National Flood Insurance Program, flood insurance is available to all homeowners and renters in these flood zones:

Flood Zone B

Flood zone B makes up areas that carry a moderate flood hazard. They typically fall between the limits of the 100-year and 500-year floods.

500-year floods have an annual exceedance probability (AEP) of 0.2%. In other words, floods of this size or greater have a 1 in 500 chance of occurring in a given year.

Zone B flood zones have base floodplains that represent lower flood risk due to either manmade features (like canals and flood control dams) or natural features (like shallow flooding areas with average depths that are less than 1 foot).

Flood Zone C

Flood zone C” constitutes areas that carry a minimal flood hazard. Zone C flood zones are depicted on FIRMs as being above the 500-year flood level (which means they have a 0.20% chance of flooding each year). Zone Cs may also have localized drainage and ponding problems that don’t warrant a formal study or designation as a base flood plain.

Zone Cs do not fall within the SFHAs and flood insurance isn’t mandatory for homeowners or renters. Still, due to climate change and other risk factors within both the built and natural environments, buying flood insurance is still something to consider. According to FEMA, just one inch of water can lead to more than $25,000 in damages for both homes and personal belongings.

Flood Zone X

Flood zone X areas carry a low to moderate flood hazard. FEMA has two designations for Zone X flood zones: shaded and unshaded. Shaded flood zones are areas with an annual flood risk of between 1% and 0.2% (moderate risk). Unshaded flood zones carry an annual flood risk of less than 0.2% and are protected from the 100-year flood by a levee.

The base flood elevation (BFE) is used by FEMA to determine flood heights in areas with an increased risk of flooding. FEMA has not assigned BFEs to either shaded or unshaded Zone Xs since neither is considered to be a flood risk.

What are High-Risk Flood Zones?

High-risk flood zones are designated as Special Flood Hazard Areas (SFHAs) on the Flood Insurance Rate Map (FIRM). SFHAs are geographic areas that are likely to experience a flood (having a 1% chance of being equaled or exceeded in a given year). In other words, there’s a 1% chance that the area will experience a flood in a given year.

In communities that are enrolled in the National Flood Insurance Program (NFIP), the purchase of FEMA flood insurance is mandatory for both homeowners and renters.

The high-risk areas are listed below.

Flood Zone A

Flood Zone A areas have a 1% chance of flooding each year. For Homeowners with a 30-year mortgage this means there is a 26% chance of flooding at this level over the lifespan of the mortgage. However, for a less intense, more frequent event like a 10-year flood, the odds increase up to a near certainty (96%). Since detailed hydraulic analyses aren’t performed at Zone A flood zones, no base flood elevations (BFEs) or depths are available.

Flood Zone AO

Flood zone AO areas have river or stream flood hazards, as well as a 1% or greater chance of shallow flooding annually. Flooding usually takes the form of sheet flows on sloping terrain with an average depth of 1 to 3 feet.

Zone AO’s likewise, have a 26% chance of flooding over the lifespan of a 30-year mortgage. Detailed analyses of average flood depths taken from hydraulic analyses are available for these zones. Alluvial fan flood hazards are designated as Zone AO on FIRM.

Flood Zone AH

Flood zone AH areas have a 1% chance of annual shallow flooding (usually in the form of ponding), with an average depth of between 1 to 3 feet. Again, there is also a 26% chance of flooding over the lifespan of a 30-year mortgage.

The BFEs taken from detailed hydraulic analyses are shown at selected intervals within Zone AH.

Flood Zones A1-A30

These areas are known as numbered A zones and range from A1 to A30. These flood zones have a 1% annual chance of experiencing a flood event. BFEs taken from detailed hydraulic analyses are available and are shown at selected intervals within these zones.

Flood Zone AE

Flood zone AE is used on new and revised FIRMs in place of Zones A1-A30.

Flood Zone A99

These areas have a 1% yearly chance of experiencing a flood event. A99 flood zones are protected by a federal flood control system as long as construction has met specific legal requirements. No BFEs or depths are shown within these zones.

Flood Zone AR

Flood zone AR areas have a temporary heightened flood risk due to the construction or restoration of a flood control system, such as a dam or levee. FEMA might classify the area as an AR flood zone if the flood control system is deemed restorable by a federal agency after consulting a local project sponsor.

While flood insurance purchase is mandatory for homeowners and renters in AR Zones, rates cannot exceed the rates for unnumbered A zones if the structure is built or restored in adherence with Zone AR floodplain management regulations.

Flood Zone AR/AE

These dual flood zones carry the risk of flooding from other water sources even after the restoration or construction of a flood control system.

Flood Zone AR/AO

These dual flood zones require flood-proof construction and flood insurance if the property owner has a mortgage. There also remains the risk of flooding even after the restoration or construction of a flood control system.

Flood Zone AR/A1-A30

Flood zone AR/A1-A30 areas are dual flood zones. Property owners who undertake floodplain management in these zones do not have to elevate their existing structures when making building improvements. However, new structures need to be elevated (or flood-proofed if they’re non-residential).

The lowest floor, together with the basement, should be at least 3 feet above the highest adjacent existing grade as long as the BFE does not exceed 5 feet at the development site.

Flood Zone AR/A

In flood zone AR/A areas, the risk of flooding from other water sources remains even after the construction or restoration of a flood control system. The purchase of FEMA flood insurance is mandatory for all homeowners and renters in these dual zones.

Flood Zone V

Areas with this flood zone designation have coastal areas and primary frontal dunes that are exposed to flooding by the 100-year flood. Since detailed coastal analyses have not been performed, no flood depths or BFEs are available. The purchase of FEMA flood insurance is mandatory for all homeowners and renters in Zone V.

Flood Zone VE

Areas with this flood zone designation have coastal areas and primary frontal dunes that are exposed to flooding by the 100-year flood. Additional hazards are present due to storm-induced velocity wave patterns. BFEs taken from detailed hydraulic coastal analyses are available within these zones.

Zone VE is used instead of Zones V1-V30 in new and revised FIRMs.

Flood Zones V1-V30

Flood zones V1-V30 are a similar situation as flood zones A1-A30, being numbered flood zones. The difference is that V1-V30 flood zones are characterized by being near a large body of water.

Being by a body of water poses a new risk – as the effects of flooding can be exacerbated by storms or hurricanes.

What Is Flood Zone D?

Flood zone D areas are those that have potential but unidentified flood hazards since no official flood analyses have been conducted. No flood insurance purchase is required for homeowners and renters residing in Flood Zone D, though coverage is available in participating communities.

According to FEMA, while there is a risk of flooding in Zone D, the level of risk remains unknown.

Is Flood Insurance Required In High-Risk Areas?

Businesses and homes situated in high-risk flood zones are required to have flood insurance if they have government-backed mortgages. The National Flood Insurance Program (NFIP) offers flood insurance that is separate from homeowner’s insurance. The policy covers a building, its contents, or both.

Flood insurance is available to anyone living in one of the 23,000 participating NFIP communities, according to FEMA. The NFIP is managed by FEMA and is available to the public via a network of 50 insurance companies and NFIP Direct.

While flood insurance is not a requirement if you don’t live in a high-risk flood zone, homeowners, business owners, and renters are advised to purchase flood insurance in order to protect their properties and assets. Your lender may also require you to buy flood insurance even if the property falls outside a high-risk flood zone.

Does Climate Change Impact Flooding?

River floods are becoming unpredictable. Along with natural climate processes and cycles, climate change is impacting these increases in frequency and severity of flooding incidents across the country and our world. Many speculate that this potential increase in flooding is due to climate change.

Here in the United States, more frequent natural disasters like Hurricanes and catastrophic flooding events have put tremendous strain on the National Flood Insurance Program (NFIP) via large amounts of repetitive claims of flood loss. As a result, the NFIP is now operating at a deficit of over $20 billion dollars which is a result of simply taking in less in flood insurance premiums than the cost to the NFIP from claims payments due to flooding losses.

Despite several Congressional interventions, the NFIP continues to experience an operational loss. This cycle is not sustainable for the program. Substantial change via reforms are needed to ensure the promise of flood insurance coverage continues to be kept.